A secure digital ID that can be used to open current and savings bank accounts everywhere in Europe, including across borders.

The context

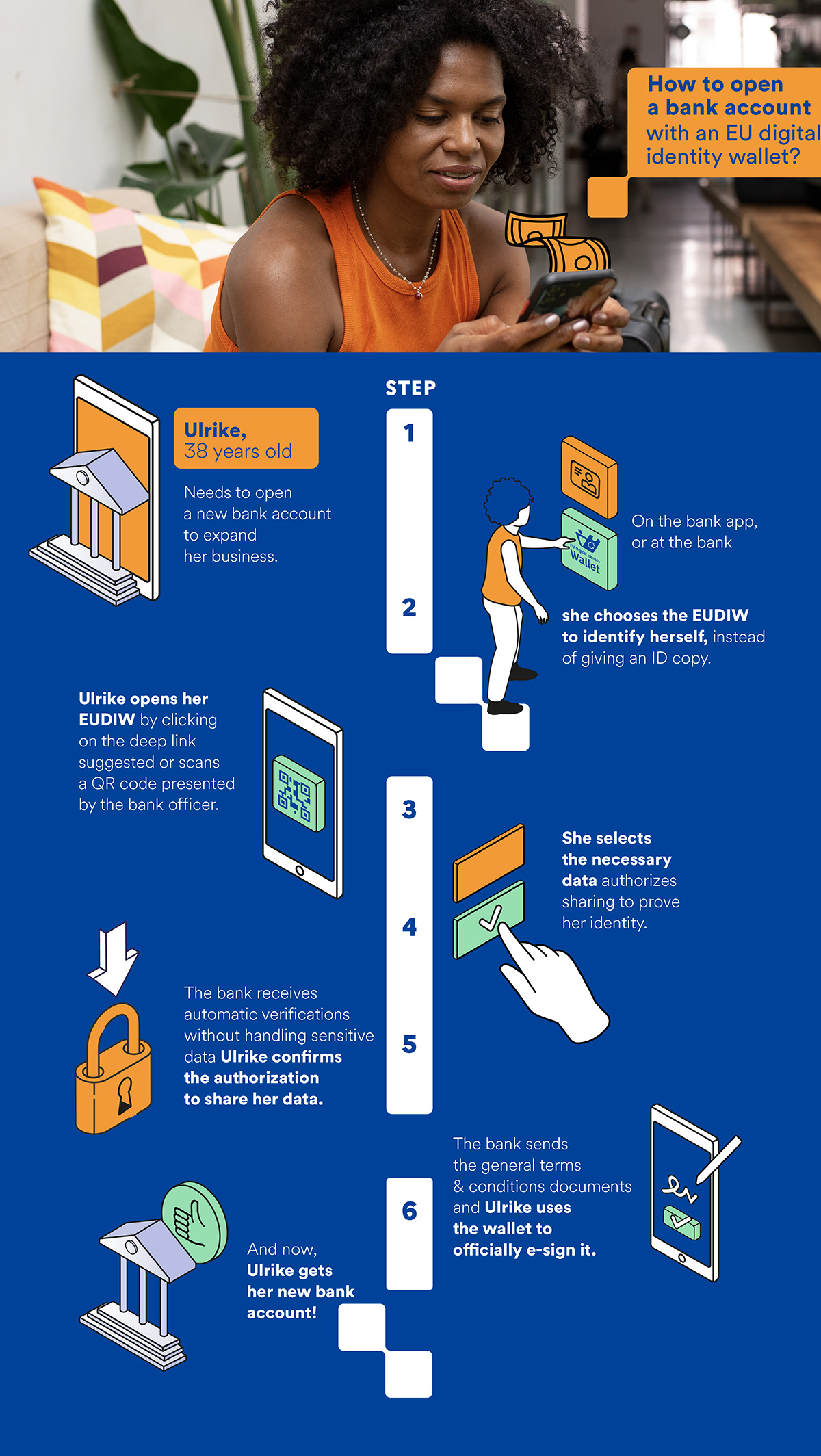

In the context of the rise of online banking, the European banking landscape must undergo transformation to align itself and cater to the needs of citizens seeking more digitized processes. Use Case 2 aims to streamline and digitalized the bank account opening process for citizens, while harmonizing practices across European financial institutions. This initiative seeks to enable European citizens to effortlessly create bank accounts anywhere in Europe, fostering a more interconnected and accessible banking environment.

As online banking continues to reshape the financial sector, the emphasis on user-friendly, digital solutions becomes paramount in ensuring a seamless and efficient experience for customers across the European Union.

Our ambitions

The aspirations for Use Case 2 are characterized by a transformative vision. Envisaging a future where individuals can uniformly open online bank accounts across Europe, the initiative seeks to establish a standardized and secure digital identification system. This approach aims not only to enhance accessibility but also instill trust and confidence in online banking. Leveraging advanced technology, the goal is to redefine conventional norms associated with account opening, ensuring a swift and hassle-free process for every use.

The benefits

The implementation of a secured authentication system anticipates a notable reduction in fraud and identity theft. Users will be relieved from cumbersome paperwork and intricate verification processes, embracing the efficiency of a seamless online experience. Furthermore, the standardized approach holds the potential to facilitate cross-border financial interactions, fostering economic fluidity within the European landscape.

Work in progress

The stocktaking process has proven instrumental in elucidating the diverse requirements of each banking institution, both in terms of procedural intricacies and the specific identity attributes they demand. This meticulous examination has provided valuable insights into the nuances that distinguish various banks’ expectations. Currently, the team is actively engaged in drafting comprehensive specifications that will serve as the blueprint for implementing a tailored process. This process aims to seamlessly accommodate the distinct demands of each institution, ensuring a harmonized and efficient approach that aligns with the intricate tapestry of requirements in the realm of online bank account opening across Europe.

The main objective of UC2 is to have 100% online bank account opening without any difficult situations for the customer.”

Antonis Stasis,

UC2 Lead